Credito

Credito creates a credit intelligence network for the credit industry to prevent credit risk by detecting fraudulent transactions when they occur, enabling the industry to make well-informed decisions. Despite the fact that financial institutions are generally known as one of the most severely regulated sectors, they are still targets for fraudsters. The consequences of fraud are not insignificant, which has led to financial difficulties for banks and clients. While financial institutions are actively engaged in fraudulent searches and reduced costs of fraud, they still do not have genuine global intellectual information about all known fraudsters and compromises.

What is the need for a decentralized and transparent Credit Intelligence platform?

Despite the efforts of banks, issuers of cards and sellers, credit card fraud continues to grow faster than credit card charges. Data breaches have led to the fact that card data has been compromised, and the growth of online stores has led to greater opportunities for e-commerce fraud. According to Nilsson’s report1, 2016, credit card fraud losses totaled $ 21.8 billion in 2015, up 162% from 2010, which is $ 8 billion. Losses for 2016 have already been estimated at 24 billion dollars, and it is expected that by 2020 these losses will amount to 31 billion dollars.

On the other hand, peer to peer (p2p) platforms are one of the fastest growing segments in the financial services industry. The market of recent years has gained popularity in alternative financing. The Transparency Market Research study finds that “the global equilibrium level of the level market will be $ 8924 billion by 2024, from $ 26 billion in 2015. It is expected that the market will increase from 48% in the period from 2016 to 48%. and 2024 biennium

The Transparency Market Research study finds that “the global equilibrium level of the level market will be $ 8924 billion by 2024, from $ 26 billion in 2015. It is expected that the market will increase from 48% in the period from 2016 to 48%. and 2024.2. “Although p2p platforms continue to face the risk of default and fraudulent practices, growth prospects for this segment remain strong, especially at a time when the banking sector continues to struggle with permanent losses. Thus, a decentralized and transparent Credit Intelligence platform offers great opportunities for creditors, borrowers and financial institutions to reduce risk.

Despite the efforts of banks, issuers of cards and sellers, credit card fraud continues to grow faster than credit card charges. Data breaches have led to the fact that card data has been compromised, and the growth of online stores has led to greater opportunities for e-commerce fraud. According to Nilsson’s report1, 2016, credit card fraud losses totaled $ 21.8 billion in 2015, up 162% from 2010, which is $ 8 billion. Losses for 2016 have already been estimated at 24 billion dollars, and it is expected that by 2020 these losses will amount to 31 billion dollars.

On the other hand, peer to peer (p2p) platforms are one of the fastest growing segments in the financial services industry. The market of recent years has gained popularity in alternative financing. The Transparency Market Research study finds that “the global equilibrium level of the level market will be $ 8924 billion by 2024, from $ 26 billion in 2015. It is expected that the market will increase from 48% in the period from 2016 to 48%. and 2024 biennium

The Transparency Market Research study finds that “the global equilibrium level of the level market will be $ 8924 billion by 2024, from $ 26 billion in 2015. It is expected that the market will increase from 48% in the period from 2016 to 48%. and 2024.2. “Although p2p platforms continue to face the risk of default and fraudulent practices, growth prospects for this segment remain strong, especially at a time when the banking sector continues to struggle with permanent losses. Thus, a decentralized and transparent Credit Intelligence platform offers great opportunities for creditors, borrowers and financial institutions to reduce risk.

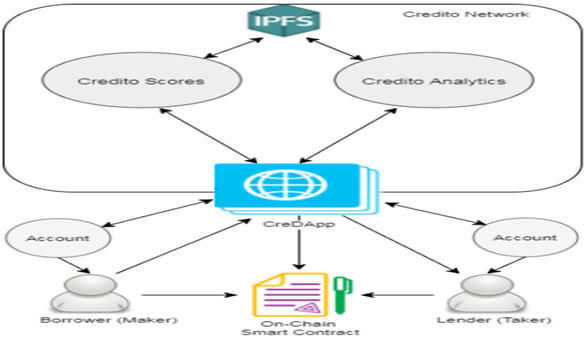

Credito scores aim to derisk the investor’s investment and the borrowers’ credit score. Credito scores are generated by Credito Analytic Engine, a self-learning algorithm using a continual feedback loop with the help of Big Data analytics , Machine learning, and Artificial Intelligence, offering a score which acts as a dynamic marker of a person’s probability to repay a loan amount, which evolves with the client’s record of loan repayment.

Official Website: https://credito.io/

Whitepaper Link: https://credito.io/pdf/whitepaper.pdf

Telegram Channel: https://t.me/CreditoCommunity

Official Facebook Page: https://www.facebook.com/CreditoNetwork

Whitepaper Link: https://credito.io/pdf/whitepaper.pdf

Telegram Channel: https://t.me/CreditoCommunity

Official Facebook Page: https://www.facebook.com/CreditoNetwork

0xd8A1429a1c82945014d7d98C6Baf136648778935

Комментариев нет:

Отправить комментарий